Human resources

Human resources

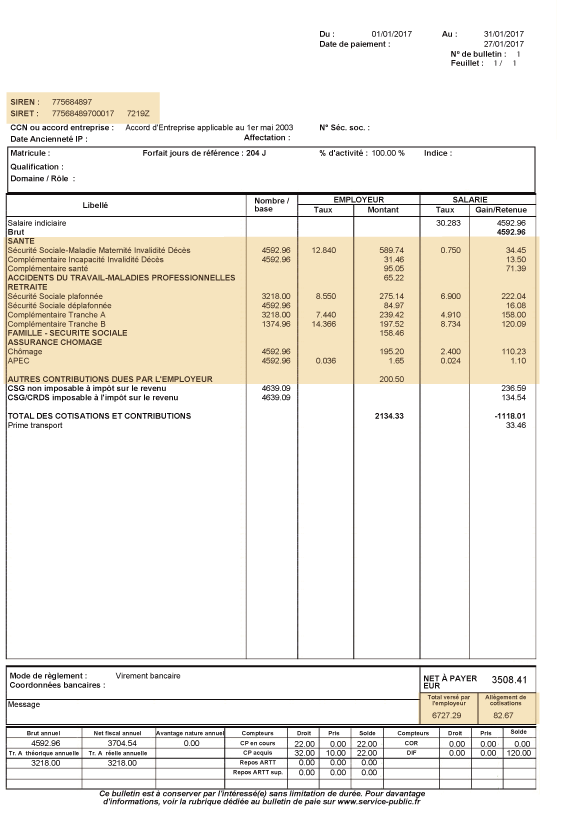

Simplification of payslips

In accordance with new legislation for all organizations with more than 300 employees, the Institut Pasteur payslip will be changing from January 2017 to comply with new presentation guidelines.

In accordance with new legislation for all organizations with more than 300 employees, the Institut Pasteur payslip will be changing from January 2017 to comply with new presentation guidelines.

What is changing?

Institut Pasteur employees will now receive a simplified, more legible payslip that clearly sets out the different contributions deducted from gross pay. This new layout should make it easier to understand exactly how much is paid in contributions by the employee and the employer, taking into account any employer exemptions.

It goes without saying that this simplification of the payslip has no impact on employees' net income.

The main changes are as follows:

Social contributions are now grouped together by the object of the coverage:

- Health

- Workplace accidents/occupational diseases

- Pension

- Family/social security

- Unemployment insurance

Other contributions payable by the employer are grouped together onto a single line

The reference of the social security organization (URSSAF) and the number under which social security contributions are paid are no longer indicated

Additional information is included about labor costs: total amount paid by the employer (gross salary + employer contributions) and state-funded reductions in contributions